Or request a free custom engine proposal for your use case

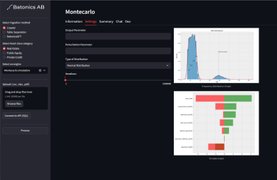

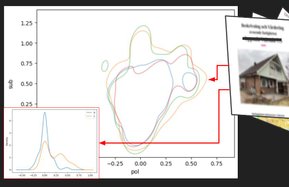

MonteCarlo Simulation, Sensitivity Analysis, NPL Portfolio Underwriting, Crowdfunded Real Estate Accounting/Marketplace, Correlation Inversion for Public Equities, Heatmapping, Automated Valuation/Pricing and Risk Management for Private Credit, Document (PDF/XLS of Financials, Projections, Prospectus) Mass Processing for Scouting and Pricing (Real Estate, Private Credit, Venture Debt)

10 April 2024

14 February 2024

5 October 2023

Reabel Partners Facilitates MoU Between SYNDICO SAS and BATONICS AB to Advance Real Estate Technology Solutions

Batonics AB and Coleman Capital sign MoU to Develop AI Engine for Early M&A Risk and Anomaly Detection for Hedge Funds

Introducing the alpha version of our AILA Platform with Universal Excel Ingestion!

Jonathan is adept with AI in finance, with a Master's degree and recognition as a Data Lab Scholar. As a Technical Consultant in a prominent financial services firm, he drives engineering and IT delivery, implementing cutting-edge solutions that streamline operations and obliterates pasta bolognese and calzones. Jonathan's expertise and passion for AI enable him to leverage advanced techniques and design efficient solutions in the financial sector.

AILA is a subscription-based one-stop shop for institutional analysis modules. Engines are the specific units/modules.

Yes, the made-to-order engines are ready for commercial use, and we usually include upgrades and maintenance too. The platform is available only to alpha clients who provide feedback as we are still constructing and debugging it.

Clients provide use cases which we tune and build the engines for. Past use cases include scenario modeling, sensitivity analysis, Monte Carlo simulation, anomaly detection for risk in NPL portfolios, asset to macro analysis, lease document ingestion and securitization, accounting automation, correlation inversion detection, M&A risk prediction, fund performance prediction, private credit diligence automation, and more.

It depends on your use case. We detail that in the quote but aim to include a 'phase one' deliverable in less than 6 weeks.

Tabular (XLS, CSV, and APIs - like Bloomberg, etc.), textual (PDFs), and soon drawings (floor plans, building zones, etc.)

All asset verticals within institutional asset management, but since our analysis is agnostic, we also look at industries like energy and biotech with similar needs.

Yes, we can work with reduced rates on a pre-contract consultancy basis for your AI model building, data analysis, data ingestion, data sourcing and statistical dashboarding needs .

Yes. Primarily data partners and market partners who have an extensive pipeline of use cases.

Your data is protected by traditional security protocols. For some clients, we offer all our engines and solutions (including the platform) as an on-premise installation on your local servers, which is a bit more costly. Our AI models won't learn from your data unless explicitly stated in our contract.

For further queries, use the form below.

Or request a free custom engine proposal for your use case

Part of The Fintech Map by EU Digital Finance Platform.

Part of European AI Startup Landscape through Sweden AI

Batonics AB is registered in Sweden

Company Registration Number: 559201-3352